Thorium has long been considered the Holy Grail of nuclear energy.

Thorium reactors have been sought out as a viable alternative to conventional nuclear reactors for a number of reasons:

- Thorium is far more abundant than uranium.

- Thorium cannot be weaponized because it doesn’t produce enough recoverable plutonium.

- Thorium doesn’t need to be enriched.

- Thorium is more efficient than conventional uranium.

- Thorium produces less nuclear waste than conventional uranium.

- Thorium reactors are “meltdown-proof.”

So it wasn’t surprising that the Shanghai Institute of Applied Physics was granted an operating license for its thorium-powered molten-salt reactor this past summer.

Construction of that reactor started in 2018, and now China plans to begin testing on it.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

If the thorium reactor proves safe and effective, the Middle Kingdom will move forward with building another thorium reactor that would be the biggest in the world, with a capacity of 373 MWt. This is expected to be up and running by 2030.

That’s not far off.

Of course, more testing will need to be done, and when it comes to building nuclear reactors, delays are not uncommon. That's unfortunate as there’s a very real thirst for new fleets of technologically advanced nuclear power plants and the fuel to power them.

Interestingly enough, it’s the latter that provides the most bang for your buck if you’re bullish on nuclear power.

This is particularly true of "Tri-Fuel 238," which is a new type of nuclear fuel that makes everything else we’ve used up to this point look foolish.

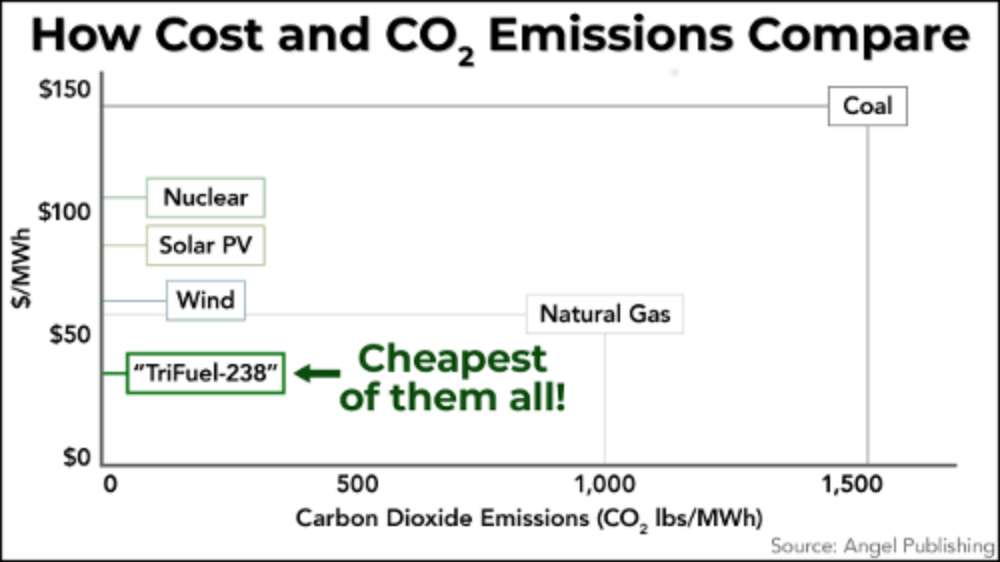

It’s emission-free and cheaper than coal and natural gas…

It’s 40,835 times more powerful than natural gas…

And it’s 67,389 times more potent than gasoline.

Even the Energy Information Administration (EIA) is on board with Tri-Fuel 238, going on record about its environmental and cost-saving advantages.

According to the EIA, compared with every other source of power generation — coal, natural gas, solar, wind, and even traditional nuclear power — Tri-Fuel 238 is significantly cheaper.

This is a very big deal. And while the progress being made on thorium reactors should not be trivialized, in the near term, there’s no doubt that Tri-Fuel 238 represents one of the most potentially profitable investment opportunities for energy investors.

That’s why the research team here at Energy and Capital put together this investment presentation on Tri-Fuel 238.

It not only details how Tri-Fuel 238 works and why it’s superior to any other type of nuclear fuel used today, but it also includes details on the company behind it and how you can own shares of it today.

While we will continue to monitor any progress being made on thorium, we will also take every opportunity to profit from Tri-Fuel 238 — and I suggest you get some of this action for yourself too.

To a new way of life and a new generation of wealth…

Jeff Siegel

Jeff is an editor of Energy and Capital as well as a contributing analyst for New World Assets.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@JeffSiegel on Twitter

@JeffSiegel on Twitter